A Note On Currency And Index Futures

<<Previous

DEFINING THE TERMS Contd..The participants in

the market are classified as hedgers, speculators and arbitrageurs. Hedgers

use futures market to reduce or eliminate the risk associated with price

fluctuations of an asset. For example, an exporter whose receivables are

denominated in another currency (say, Euro) runs a significant foreign

exchange risk, because of the possible adverse movement in the price of the

other currency vis-a-vis the home currency. The exporter can hedge the above

risk by selling futures in Euro. Speculators are those who are willing to

take the risk that the hedgers are seeking to avoid. They use futures

contracts to benefit from betting on future movements in the price of an

asset. They seek to make gains by taking long and short positions in futures

based on their own views and forecasts about the market. Arbitrageurs look

for profit from the discrepancy between prices in two different markets.

CLEARING HOUSE:

|

A clearing house is a part of the futures exchange and

acts as an intermediary in futures transactions. All futures contracts

are routed through a clearing house which is a ‘de facto'guarantor for

all futures transactions. A clearing house works closely with the

exchange but is an entity distinct from the exchange. Since all

transactions are routed through it, the clearing house becomes the buyer

to every seller and seller to every buyer. Let us understand the process

with the help of following illustration:

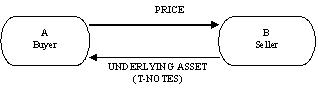

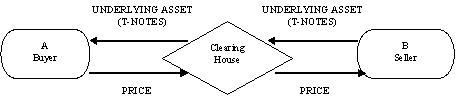

There are two parties, A and B, who want to enter into a futures

contract. A typical transaction with, and without, the involvement of a

clearing house would be as follows: |

|

In the first case, where the transaction

takes place without the clearing house both A and B assume the counterparty

risk[5] because on the date of the contract, B may fail to deliver the

underlying asset or A may fail to pay the price. In the second case, the

clearing house replaces B as a seller to A, and A as a buyer to B, and thus

the credit risk taken by both A and B becomes insignificant. FIGURE I

TRANSACTION WITHOUT CLEARING HOUSE

TRANSACTION INVOLVING CLEARING HOUSE

The clearing house assumes many important functions like ensuring smooth trading by maintaining delivery schedules, minimizing credit risk by becoming counterparty to every transaction, monitoring speculation margins and more. Since the clearing house undertakes counterparty risk for all transactions, the total risk assumed by it is high. Thus, it becomes important for the clearing house to minimize this risk, which is done by collecting margins. Margins are levied for all transactions depending on the volatility of the underlying asset, and adjustment is done everyday depending upon the prices, a process known as marking to market.

TYPES OF MARGIN:

SETTLEMENT PROCEDURES

APPLICATIONS OF FUTURES

TYPES OF FUTURES

TRADING USING CURRENCY FUTURES

TRADING USING INDEX FUTURES

CONCLUSION

EXHIBIT I DIFFERENCE BETWEEN FUTURES AND FORWARDS CONTRACTS

EXHIBIT II A NOTE ON ANALYZING FUTURES PRICES

ADDITIONAL READINGS AND REFERENCES

[5] The risk to each party of a contract that the counterparty will not live

up to its contractual obligations.

2010, ICMR (IBS Center for Management Research).All rights reserved. No part of this publication may be

reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted

in any form or by any means - electronic or mechanical, without permission.

To order copies, call +91- 8417- 236667 or write to ICMR,

Survey No. 156/157, Dontanapalli Village, Shankerpalli Mandal,

Ranga Reddy District,

Hyderabad-501504.

Andhra Pradesh, INDIA.

Mob: +91- 9640901313, Ph: +91- 8417- 236667,

Fax: +91- 8417- 236668

E-mail: info@icmrindia.org

Website: www.icmrindia.org

|